Manufacturing products in 1C 8.3. Accounting for finished products in 1C: Accounting

Sales of products- one of the main economic operations of a manufacturing enterprise.

The correct reflection of this operation is of great importance for the formation of product costs, and therefore it is important to follow the basic principles.

Firstly, the program must maintain the correct chronological sequence of document entry - i.e. Products must be received at the warehouse before they are sold.

Secondly, products must be written off from the warehouse to which they were received (or moved).

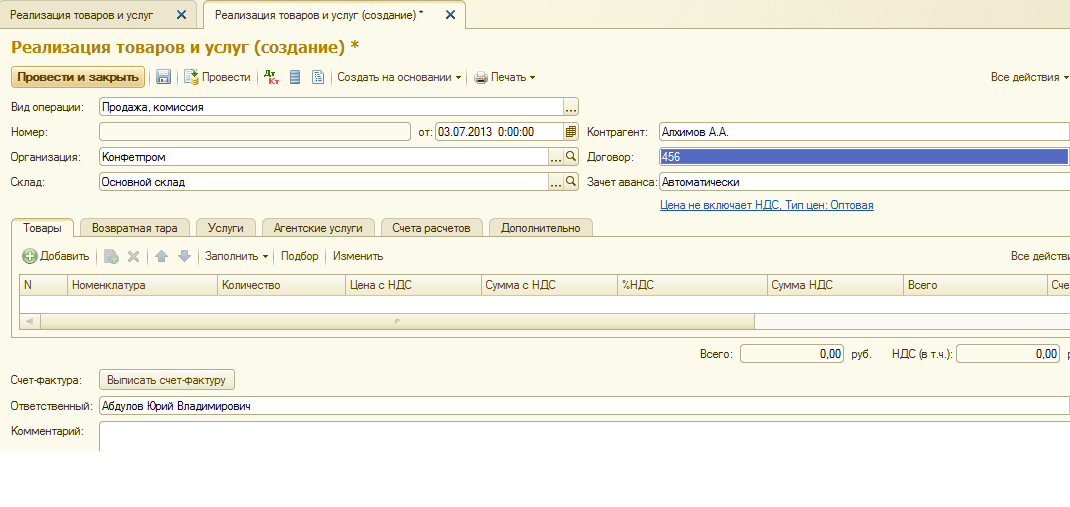

To reflect product sales in the program 1C Accounting 8 The document “Sales of goods and services” is used.

You can find a list of documents “Sales of goods and services” in the “Purchases and Sales” section, subsection “Sales”, link “Sales of goods and services”.

A new document form will open.

We indicate the type of transaction “Purchase, commission”.

The “Organization” detail will be filled in automatically if the main organization is specified in the user settings or only one organization is kept in the system.

In the “Warehouse” attribute, select the warehouse from which we sell products.

We select a counterparty-buyer, or enter it into the “Counterparties” directory if we are selling products to this buyer for the first time.

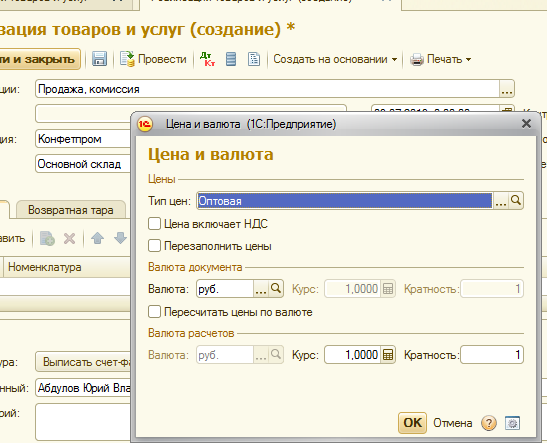

We enter an agreement with the counterparty. It is important to correctly indicate the type of contract - “with the buyer”. If we want the same type of prices to be always indicated in the sales documents for this buyer, we select this type of prices in the contract (for this desired type prices must be entered into the directory “Item Price Types”).

The “Advance offset offset” detail can be set in the “do not offset” provisions (i.e., advance offset entries are not generated even if there is an advance payment from the buyer), “automatically” (i.e., the program analyzes the presence of an advance payment for a given buyer and agreement) and “according to document” (in this case, you must indicate the advance document). The default is set to “automatic”, I recommend leaving it in this position.

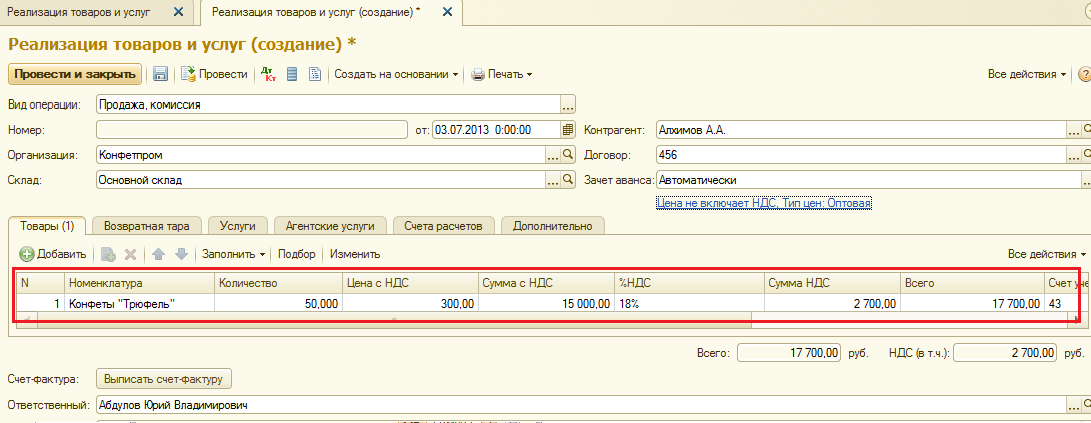

We fill out the tabular part of the document from the “Nomenclature” directory using the “ button. We indicate the quantity of products.

If pre-filled, then when you select an item in the line, the accounting account, VAT account, and income and expense accounts for the sale of these products will be automatically filled in.

If product prices are not filled in for the previously specified price type, then you will have to enter the product sales price manually.

Depending on the previously made settings, the VAT amount will be automatically calculated.

Using the “Write an invoice” button, you can generate an “Invoice issued” document based on this document.

After entering all the details, we submit the document. Let's look at the transactions generated by the document:

![]()

Posting debit 90.02, credit 43 reflects the write-off of products at planned cost.

The second entry reflects the sale of products at sales price, including VAT.

The third entry allocates the amount of VAT.

Clicking the “Print” button opens a list of printable forms that can be generated from this document.

For this operation, the forms “Consignment note”, “Invoice”, “Consignment note (TORG-12)”, “Consignment note 1-T” and “Transport bill of lading” are suitable for us.

To learn how to correctly set up the signatures of responsible persons so that they are displayed automatically in printed document forms, read

The latest releases of version 4.5 of the 1C: Accounting program have significantly expanded the capabilities of automating various areas of accounting. The section "Release of finished products" did not go unnoticed. In this article, the leading consultant of the training center "Master Service Engineering" E.A. Denisova tells how best to account for finished products in 1C: Accounting.

In the "1C: Accounting" configuration, the method of accounting for finished products is set by a periodic constant in the "Operations" menu, which is called "Method of accounting for finished products and semi-finished products." By default, the value is set to “At actual cost”, since this particular method of accounting corresponds to the norm of paragraph 5 of PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n. Another value (“At planned cost”) is left as a reserve for cases where the configuration will be used to restore accounting records for 2001, when PBU 5/01 has not yet come into effect. In our article we will look at how the “actual cost” accounting method is implemented in practice.

Before starting to work with the program, you must fill out the directory “Types of products, works, services”, defining for each element of the directory the “Type of item” (for finished products this is “Products”, respectively). An example of directory organization is shown in Fig. 1.

The elements of this directory are objects of analytical accounting on account 20 (subaccount 1). During the month, production costs are collected on the debit of account 20 for each type of product and by cost item. In order for production costs to be attributed to the cost of a certain type of finished product, in all reference books and documents where account 20 is used, it is necessary to indicate the type of product in the cost of which these costs should be included. For example, when filling out the “Employees” directory for employees directly involved in the production process, it is necessary to indicate the cost of which product the salary of a particular employee relates to. As can be seen from Fig. 2, the salary of Andrey Ivanovich Antonov and tax deductions from his salary will be charged to the cost of paving slabs. The "Fixed Assets" directory is filled out in the same way. As a result, depreciation is charged to the cost of products in the production of which this fixed asset is involved.

We invite you to consider the method of accounting for finished products at actual cost using the example of an enterprise that produces several types of products.

Example

Krona LLC produces several types of finished products: curbs and paving slabs.

During the month, materials were purchased in the amount of 171,100 rubles. (including VAT 18% - 26,100 rubles). The following materials were released:

- for the production of borders - in the amount of 2,500 rubles;

- for the production of paving slabs - in the amount of 82,500 rubles.

The company used the services of a third party to transport finished products (curbs) from the workshop to the warehouse - 1,770 rubles. (including VAT 18% - 270 rubles). Within a month, the finished products were shipped to the buyer:

- sidewalk curb - 100 pcs. 150 rub. = 15,000 rub. (without VAT)

- paving slabs "Hexagon" - 500 pcs. 130 rub. = 76,700 rub. (without VAT)

- paving slabs "Herringbone" - 100 pcs. 400 rub. = 40,000 rub. (without VAT).

Let us consider sequentially the stages of the production cycle:

- Release of materials into production.

- Third-party company services.

- Output.

- Sales of finished products.

- Closing of the month.

1. Release of materials into production.

The release of materials into production is carried out using the document “Movement of materials”. In the document, you select the type of transfer "Transfer to production", cost allocation account 20 and the type of item for the production of which materials are transferred. Below are the transactions that are generated when posting a document (in our case, the release of materials for the production of paving slabs):

Debit 20 “Main production” Credit 10.1 “Raw materials and materials” - 30,000 rubles. - material transferred to production (paving slabs) - Expanded clay 300 m3 for 100 rubles. Debit 20 “Main production” Credit 10.1 “Raw materials and materials” - 45,000 rubles. - transferred to production (paving slabs) material - Dye 300 kg for 150 rubles. Debit 20 “Main production” Credit 10.1 “Raw materials and materials” - 7,500 rubles. - material transferred to production (paving slabs) - sand 150 m3 for 50 rubles.

2. Third party services.

The company used the services of a third-party organization to transport finished products (curbs) from the workshop to the warehouse - 1,770 rubles. (including VAT 18% - 270 rubles). These services were included in the cost of curbs. In the document “Services of third-party organizations”, account 20 is selected as the corresponding account, and border is selected as subaccount 1. As a result of posting the document, the following transactions will be generated:

Debit 20 Credit 60/76 - 1,500 rub. - services for transportation of finished products Debit 19 Credit 60/76 - 270 rub. - accepted for VAT crediting.

3. Product release.

The following finished products were produced in a month:

- sidewalk curb - 100 pcs. 120 rub. = 12,000 rub.

- paving slabs "Hexagon" - 500 pcs. 105 rub. = 52,500 rub.

- paving slabs "Herringbone" - 100 pcs. 390 rub. = 39,000 rub.

Product release is carried out in the program by the document “Transfer of finished products to the warehouse” (Fig. 3)

When finished products arrive at the warehouse during the month, we do not always know their actual cost (for example, wages and depreciation will be expensed only at the end of the month), so finished products are delivered to the warehouse at the planned cost (the “Cost” column of the document). To automatically enter the planned cost into a document in the "Nomenclature" directory, the "Planned cost" attribute must be filled in for the manufactured products, that is, the approximate amount of costs for the production of one unit of this product.

When calculating the cost of production, the postings will be generated based on the planned cost specified in the document; in our example, the documents “Transfer of finished products to the warehouse” will generate the postings:

Debit 43 “Finished products” Credit 40 “Product output” 12,000 rub. - Border 100x30x70 (100 pieces for 120 rub.); Debit 43 “Finished products” Credit 40 “Product output” 52,500 rub. - Paving slabs “Hexagon” (500 pieces, 105 rubles each); Debit 43 “Finished products” Credit 40 “Product output” 39,000 rub. - Paving slabs "Herringbone" (100 pieces for 390 rubles).

4. Sales of finished products.

Within a month, the finished products were shipped to the buyer:

- sidewalk curb - 100 pcs. 150 rub. = 15,000 rub. (without VAT)

- paving slabs "Hexagon" - 500 pcs. 130 rub. = 76,700 rub. (without VAT)

- paving slabs "Herringbone" - 100 pcs. 400 rub. = 40,000 rub. (without VAT).

For this purpose, a document “Shipment of goods, products” is created. In the document, the sales price is indicated in the “Price” column, and the following transactions are generated:

Debit 90.2.1 “Cost of sales not subject to UTII” Credit 43 “Finished products” - 12,000 rubles. - finished products were shipped from the warehouse at a cost of 100 pcs. 120 rubles each Debit 62.1 “Settlements with buyers and customers (in rubles)” Credit 90.1.1 “Revenue from sales not subject to UTII” - 17,700 rubles. - revenue received from sales is reflected

5. Closing the month.

Closing the month is The final stage production cycle, a document closing accounts 20 and 40, which, in the absence of work in progress, should not have balances at the end of the month. It would not be amiss to remind you that before generating the “Month Closing” document, it is necessary to post all the documents that form the postings to the debit of account 20, including payroll and depreciation. In Fig. Figure 4 shows the “Month Closing” document, which should be carried out when writing off finished products at actual cost.

When performing the action "Calculation and adjustment of the cost of GP and PF" (which is performed when posting a document for closing the month):

- Account 20 is closed to the debit of account 40 in terms of expenses attributable to the cost of products released in the current month;

- Direct expenses are distributed to the cost of manufactured products (written off from account 40);

- Adjustment of product write-off transactions to its actual cost.

In our example, the “Month Closing” document will generate the following transactions:

Debit 40 Credit 20 - 888.89 - closing account 20 (Curb, Depreciation) Debit 40 Credit 20 - 1,080.00 - closing account 20 (Curb, Unified Social Tax) Debit 40 Credit 20 - 5,000.00 - closing account 20 (Curb , Wage) Debit 40 Credit 20 - 2,500.00 - closing account 20 (Curb, Material costs) Debit 40 Credit 20 - 1,500.00 - closing account 20 (Curb, Third party services) Debit 40 Credit 20 - 700.00 - closing account 20 (Curb, Social Insurance Fund from taxes and payroll) Debit 40 Credit 20 - 1,512.00 - closing account 20 (Paving slabs, Unified Social Tax) Debit 40 Credit 20 - 7,000.00 - closing account 20 (Paving slabs, Salary) Debit 40 Credit 20 - 82,500.00 - closing account 20 (Paving slabs, Material costs) Debit 40 Credit 20 - 980.00 - closing account 20 (Paving slabs, Social Insurance Fund from tax and payroll) Debit 43 Credit 40 (reversal) - 331.11 - Adjustment of product output (Curb 100x30x70) Debit 90.2.1 Credit 43 (reversal) - 331.11 - adjustment of production costs (Curb 100x30x70) Debit 43 Credit 40 - 209.70 - adjustment of product output (Herringbone paving slabs ) Debit 90.2. Credit 43 - 209.70 - adjustment of production costs (Herringbone paving slabs) Debit 43 Credit 40 - 282, 30 - adjustment of product output (Hexagon paving slabs) Debit 90.2.1 Credit 43 - 282.30 - adjustment of product costs (Paving slabs "Hexagon")

When posting the “Month Closing” document with the “Generate report when posting document” checkbox selected, you can generate a report that will allow us to examine in detail how the cost of finished products was calculated and adjusted. In the monthly closing report, the lines that are highlighted more than dark color and underlined, these are the so-called “links” that can be opened with a mouse click (Fig. 5).

In our example, the lines “Calculation of the cost of manufactured products and semi-finished products” and “Adjustment of the cost of products and semi-finished products” will be underlined. Thus, you can see how the program calculated the cost of production (Fig. 6).

The data in this report coincides with the analysis of account 20 for subconto, but is presented in a more visual form. In addition, the amount of direct costs that “fell” on the cost of each type of product by cost item can be deciphered by double-clicking in column 4 of the corresponding row of the table (Fig. 7).

The report in Figure 7 shows the reflection of direct costs broken down by cost items (turnovers D40-K20 by type of product).

Column 7 can also be deciphered by double-clicking the mouse, which produces a report on the type of product, which compares its planned and actual cost.

The report on the adjustment of product write-off transactions is presented in Fig. 8.

A negative adjustment is obtained if the planned cost of manufactured products (which we indicated in the document “Product Output”) exceeds the actual amount of costs for the production of these products, a positive adjustment - if the amount of costs for the production of products exceeds the planned cost of production.

02.09.2012

Production costs

Accounting for production costs in the 1C: Accounting 8 program is carried out in the context of item groups (types of activity). They must first be entered into the directory “Nomenclature Groups” ( menu: “Enterprise - Goods (materials, products, services)”).

Example:

Direct production costs are recorded in accounts 20 “Main production” and 23 “Auxiliary production”. This includes everything that can be attributed to specific types manufactured products (semi-finished products, production services): raw materials written off for production, depreciation of capital equipment, wages and payroll taxes of production workers, as well as some services.

Ready solutions (ready to install and do not require additional configuration)

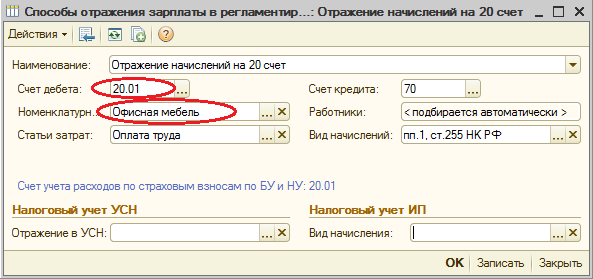

During the month, direct costs are reflected in the program using documents such as “Request-invoice”, “Receipt of goods and services” (the “Services” tab), “Advance report” (the “Other” tab), “Payroll”, as well as regulatory operations “Depreciation and depreciation of fixed assets”, “Calculation of taxes (contributions) from the payroll” and some others. You should pay attention to the correct indication of the nomenclature group both in documents and in the methods of reflecting depreciation expenses and reflecting wages in accounting.

Examples of direct production costs

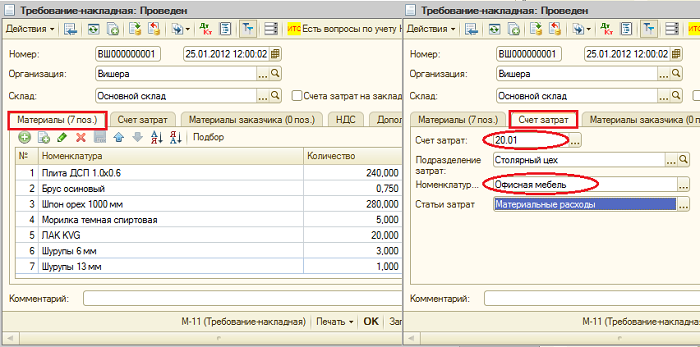

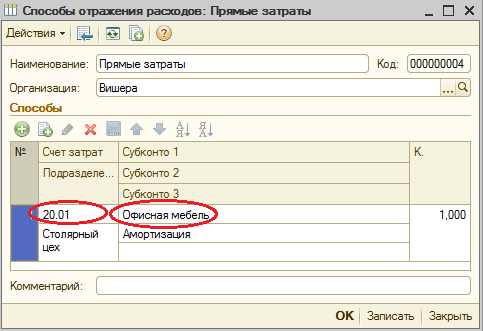

The “Requirement-invoice” document (menu or “Production” tab) reflects the write-off of materials for production. The cost account and analytics are listed on the Cost Account tab. When posting the document, posting Dt 20.01 Kt 10 will be generated, with the corresponding analytics for account 20 (division, item group, cost item).

Method of reflecting depreciation expenses (menu or tab “OS” or “Intangible assets”). If you choose this method when accepting a fixed asset for accounting (accepting intangible assets for accounting, transferring work clothes into operation), then depreciation for this fixed asset (depreciation of intangible assets, repayment of the cost of work clothes) will be assigned to the specified account and cost analytics. IN in this case the posting will be generated Dt 20.01 Kt 02.01.

Method of reflecting wages in accounting (menu or “Salary” tab). If you specify this method in the accrual, the employee’s salary and payroll taxes will be charged to the appropriate account and cost analytics. In this case, when accruing salary, the posting Dt 20.01 Kt 70 will be generated.

At the end of the month, direct expenses collected on accounts 20 and 23 are distributed between manufactured products and work in progress by item groups (types of activity). Distribution occurs through routine month-end closing operations.

In addition, there are general production and general business expenses, which are accounted for in accounts 25 and 26, respectively.

General production expenses during the month are charged to account 25. To reflect them, the same documents can be used as to reflect direct costs. At the end of the month, costs collected on account 25 are distributed to account 20 by item groups (types of activity), within a specific division, in accordance with the distribution base, using routine operations.

General business expenses during the month are charged to account 26. To reflect them, the same documents can be used as to reflect direct costs. At the end of the month, expenses collected on account 26 can be written off in two ways. They can be distributed to account 20 according to item groups (types of activity) of the entire enterprise, in accordance with the selected distribution base. Or, if the “direct costing” method is used, general business expenses are written off directly to account 90.08 “Administrative expenses” in proportion to sales revenue.

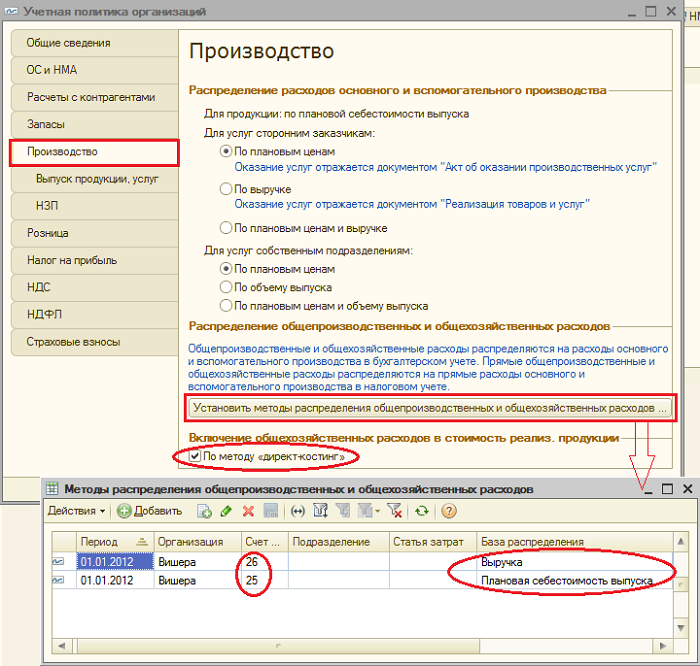

Cost accounting is set up in the form of the organization’s accounting policy (menu or “Enterprise” tab).

On the “Production” tab, the methods for distributing general and general production expenses are indicated using the “Set distribution methods...” button. In the form that opens, you need to indicate for each account the distribution base, which can be the volume of output, the planned cost of production, wages, material costs, revenue, direct costs, and individual items of direct costs. If necessary, you can detail the methods of distribution by departments and cost items.

Here you can configure the use of the direct costing method and the distribution of production costs for services.

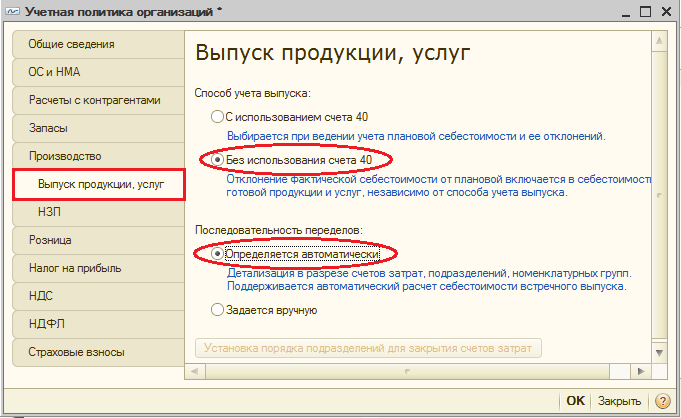

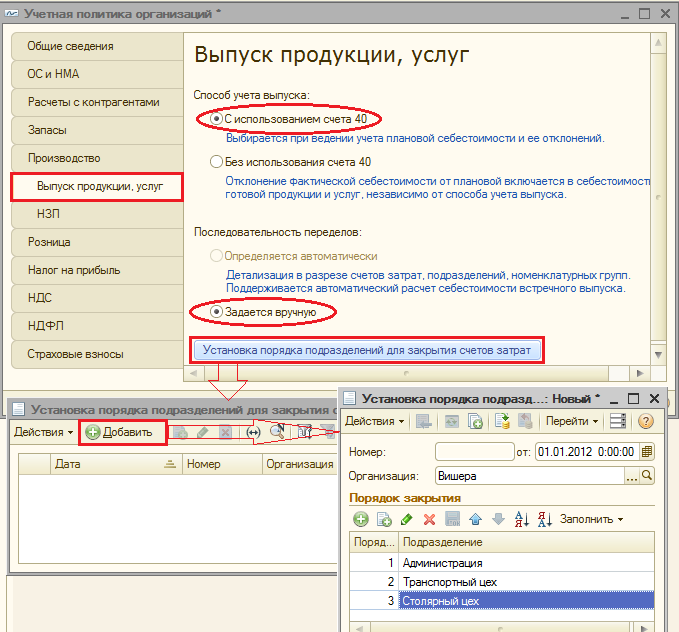

On the “Product Output” tab, you select the method of accounting for the output of finished products (semi-finished products, production services) - with or without using account 40. Here you must also specify the definition of the sequence of redistributions for closing accounts, which is important for multi-distribution production. It is recommended to select automatic detection. If production is accounted for at planned cost using account 40, then automatic calculation of the sequence of redistributions is impossible. In this case, you need to select the manual method, and then manually set the order of divisions for closing accounts (using the button).

Automatic determination of the sequence of processing steps is set:

A manual determination of the sequence of repartitions has been set, the order of divisions has been established:

Production and sale of finished products

The output of products (semi-finished products, production services to its own divisions) is reflected in the program by the document “Production report for the shift” (menu or tab “Production”). The manufactured products are accounted for at the planned cost, the document generates the posting Dt 43 Kt 20 (or, if the use of account 40 is specified, the posting Dt 43 Kt 40). It is necessary to correctly indicate the product group for the released product.

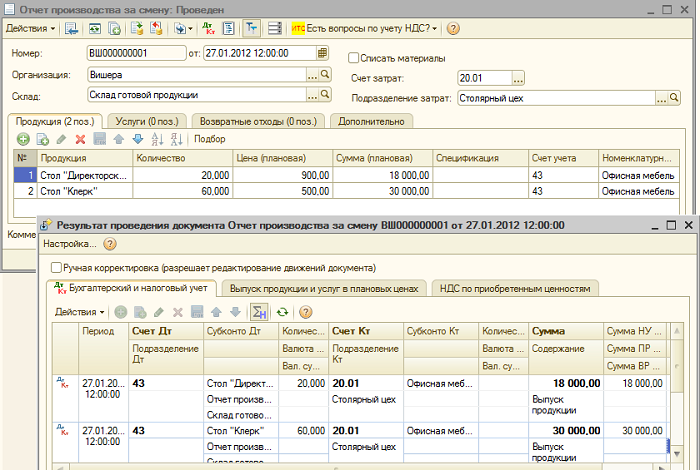

Document “Production report for the shift” and the result of its implementation (account 40 is not used):

For correct calculation cost in the program, it is necessary to comply with the principle of matching income and expenses in the context of product groups (types of activity). That is, if there are costs for a product group, they must correspond to the output and income for this product group.

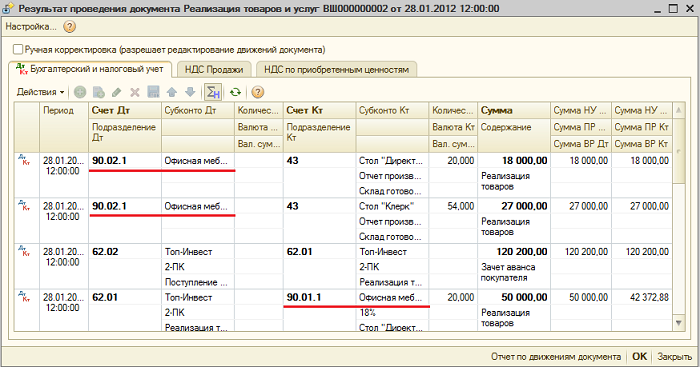

Sales of finished products are reflected in the document “Sales of goods and services”, with a revenue entry being generated: Dt 62 Kt 90.01, and a posting for writing off the cost of goods sold: Dt 90.02 Kt 43. Analytics of accounts 90.01 and 90.02 – item groups (types of activity).

Result of document implementation for product sales:

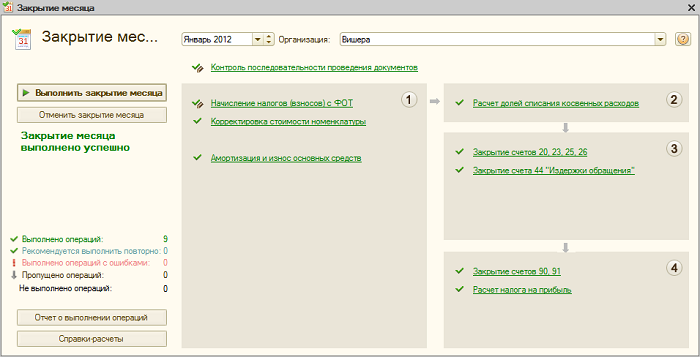

Closing the period and calculating the actual cost

Closing cost accounts and calculating the actual cost of manufactured products (semi-finished products) is carried out at the end of the month through routine operations. Previously, routine operations must be carried out to calculate depreciation of fixed assets and intangible assets, repay the cost of workwear, write off deferred expenses, calculate wages and payroll taxes.

You can use the routine processing “Month Closing” ( menu: "Operations"). In this case, the program itself will “determine” which routine operations are necessary and carry out them in the correct sequence. Execution occurs by clicking the “Perform monthly closing” button.

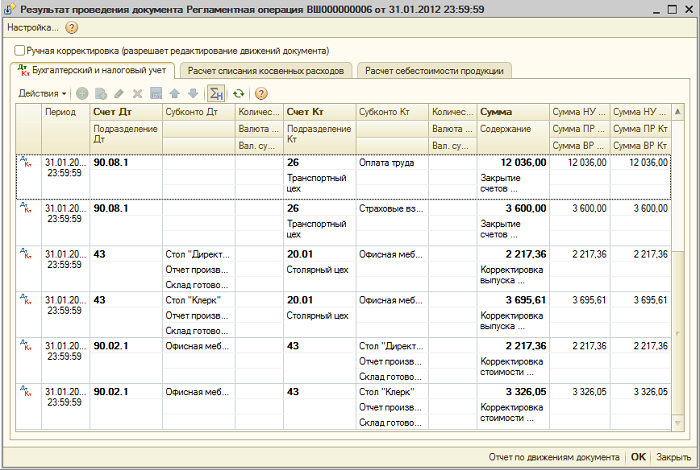

When carrying out the routine operation “Closing accounts 20, 23, 25, 26”, several stages are performed: distribution of indirect costs (according to the established “Distribution Methods”), calculation of direct costs for each product and for each division, cost adjustment.

Let us give an example of the operation “Closing accounts 20, 23, 25, 26” (the organization uses the “direct costing” method). There are entries for closing account 26 (not all are visible in the figure), adjusting product output, and adjusting the cost of goods sold. (Adjustment amounts can also be negative if the actual cost is less than planned).

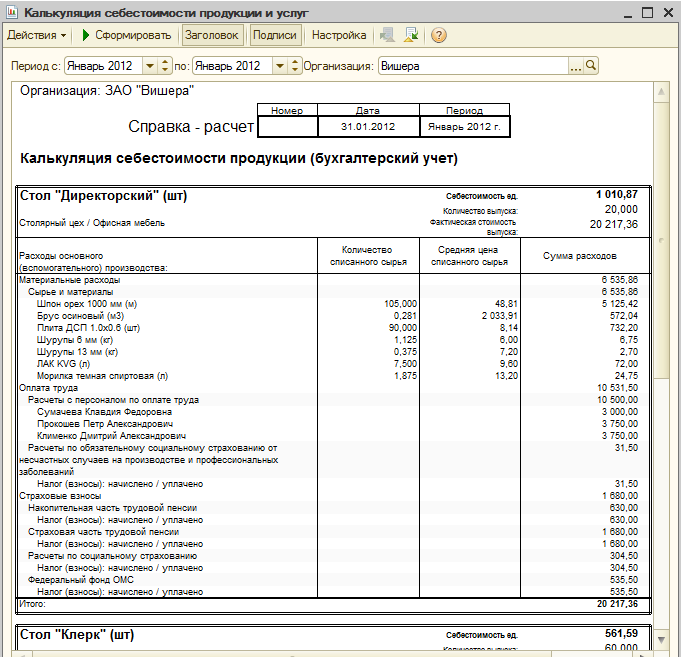

After closing cost accounts, you can generate calculation certificates (available from the “Month Closing” processing or through menu: “Reports – Help and calculations»).

Help-calculation “Calculation”:

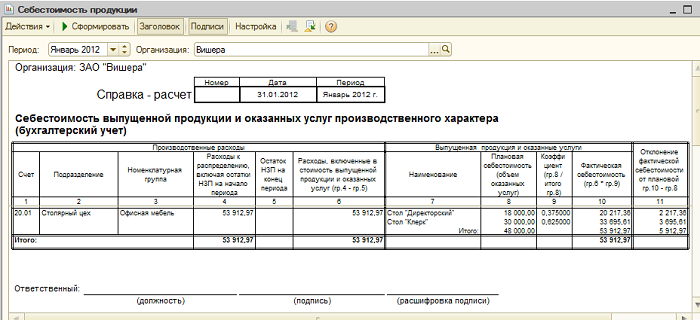

Help calculation “Product cost”:

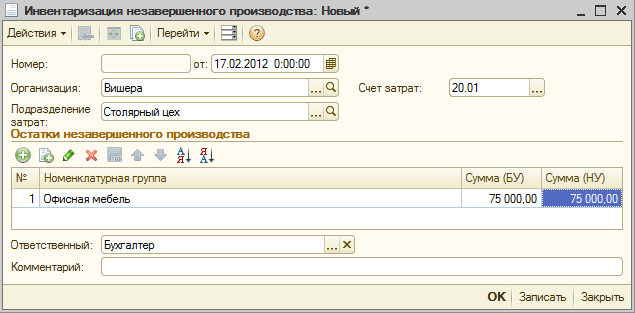

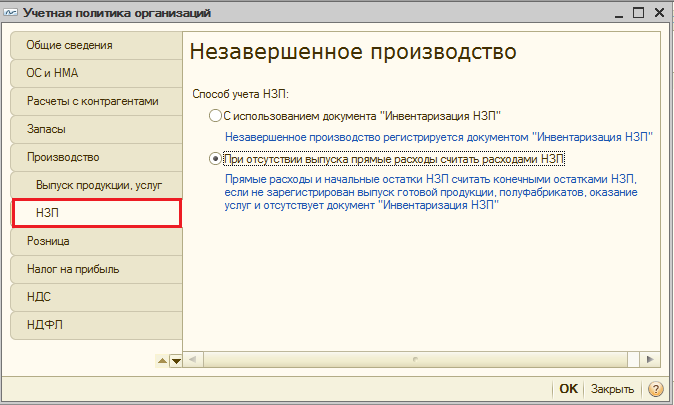

Unfinished production

If production expenses were incurred during the period, but there was no output (semi-finished products, production services), or it was incomplete, then account 20 is not closed, the value of work in progress (WIP) remains on it and is transferred to the next month. Accounting for work in progress can be configured in the form of the organization’s accounting policy, on the “WIP” tab. The default method is usually “In the absence of release, consider direct expenses as WIP expenses”:

If, in the accounting policy, the WIP accounting method “Using the WIP Inventory” document is selected, then if there is work in progress, it will be necessary to enter the “WIP Inventory” document before closing the month. Here you manually indicate the amounts of work in progress for each item group: